Our financial planners have their hands on our life savings and access to our personal and financial information. We confide in them about our goals, our dreams, and the future of our children. But, what do we really know about them when we give them access to our financial life? Often very little or nothing at all.

How can you find information about your financial planner?

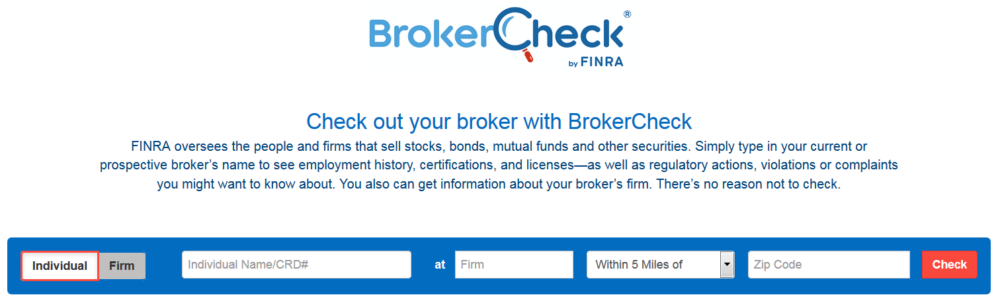

First, does he sell mutual funds, stocks, bonds or securities? If so, he is regulated by the Financial Industry Regulatory Authority (FINRA). If he is regulated by FINRA, consumers can use BrokerCheck by FINRA to find information about him. BrokerCheck provides information on all individuals or firms regulated by FINRA. Consumers can get a financial planner’s employment history, licenses, and whether they have had any complaints, violations or judgments against them.

BrokerCheck generates a report of information, which includes financial planner’s CRD number. It also provides the name of the firm for which they work and that firm’s CRD number. CRD stands for Central Registration Depository. It is a database of information about financial planners, brokers, and brokerage firms regulated by FINRA.

Next, does the financial planner sell annuities, insurance or other state regulated financial products? If so, she is regulated by the state in which she is selling the products. Consumers can verify a financial planner’s the state licenses through their state’s licensing authority. In Florida, the Florida Department of Financial Services licenses individuals who sell insurance and annuities. To check if a financial planner is licensed in Florida, consumers can use Florida’s Licensee Search tool.

Once a consumer has a financial planner’s state license and CRD numbers, she can contact her state’s financial regulatory agency and request information about any complaints or disciplinary action s involving the planner. Many states have the results of recent regulatory actions available on line. In Florida, consumers can review disciplinary orders on line.

s involving the planner. Many states have the results of recent regulatory actions available on line. In Florida, consumers can review disciplinary orders on line.

NOTE: While most financial planners hold both state and federal licenses, not all do. When verifying a financial planner’s credentials make sure to check both FINRA the state’s licensing agency.

Finally, does the financial planner claim to hold any special certifications? These are certifications are usually represented by letters following the financial planner’s name. These letters represent a variety of designations. Some designations require training and testing by an accredited company or agency. Others are obtained merely by paying fees. Some designations are th rough companies that allow consumers to register complaints. Since financial planners use these designations to claim certain expertise or specialized knowledge, consumers should know what they mean and how they were obtained.

rough companies that allow consumers to register complaints. Since financial planners use these designations to claim certain expertise or specialized knowledge, consumers should know what they mean and how they were obtained.

For a list of financial professional designations visit FINRA’s Professional Designations page. This tool allows consumers to determine what a designation means, how difficult it was to obtain, and if there is a way to verify whether a financial planner actually holds the designation.

Many states and FINRA realize seniors are particularly vulnerable to predatory financial planners. FINRA has a special hotline available to seniors. If seniors have questions about their investments or their broker, they can contact FINRA’s senior helpline at (844) 574-3577.